Navigating the world of vehicle ownership can be a maze, especially when the title’s nowhere to be found. In Missouri, there’s a solution: the bonded title. It’s a handy tool for those who’ve bought a vehicle without a proper title, or if it’s been misplaced over time.

The bonded title acts as a safety net, providing proof of ownership when the standard title is missing. It’s not just a quick fix, but a legally recognized document that can help avoid potential legal complications. In the following article, we’ll delve deeper into the nuances of bonded titles in Missouri, guiding you through the process step-by-step.

Understanding a Bonded Title

Diving deeper into the concept, this section aims to shed light on what a bonded title is and why it holds significance, specifically in the state of Missouri.

Definition and Use of a Bonded Title

A bonded title, known also as surety bond title, represents a specific title classification acquired via the surety bond method. Essentially, if a person purchases a vehicle lacking a proper title, they can apply for a bonded title. It serves, then, as legally recognized proof of ownership. A bonded title can also come into play when an individual has physical possession of a vehicle but finds themself unable to demonstrate appropriate evidence of ownership.

In the process of getting a bonded title, the purchaser files for a surety bond equal to the assessed value of the car. The bond itself acts as an insurance policy guaranteeing that the purchaser is the legal owner of the vehicle. In case someone else claims ownership, the bond guarantees compensation for the claimant, conditional on the claim’s validity.

Importance of Bonded Titles in Missouri

In Missouri, the relevance of bonded titles becomes apparent due to a couple of primary reasons. Firstly, possession of a bonded title brings an element of security and reliability for vehicle owners. It helps to avoid any legal issues that may arise due to a lack of proper vehicle documentation.

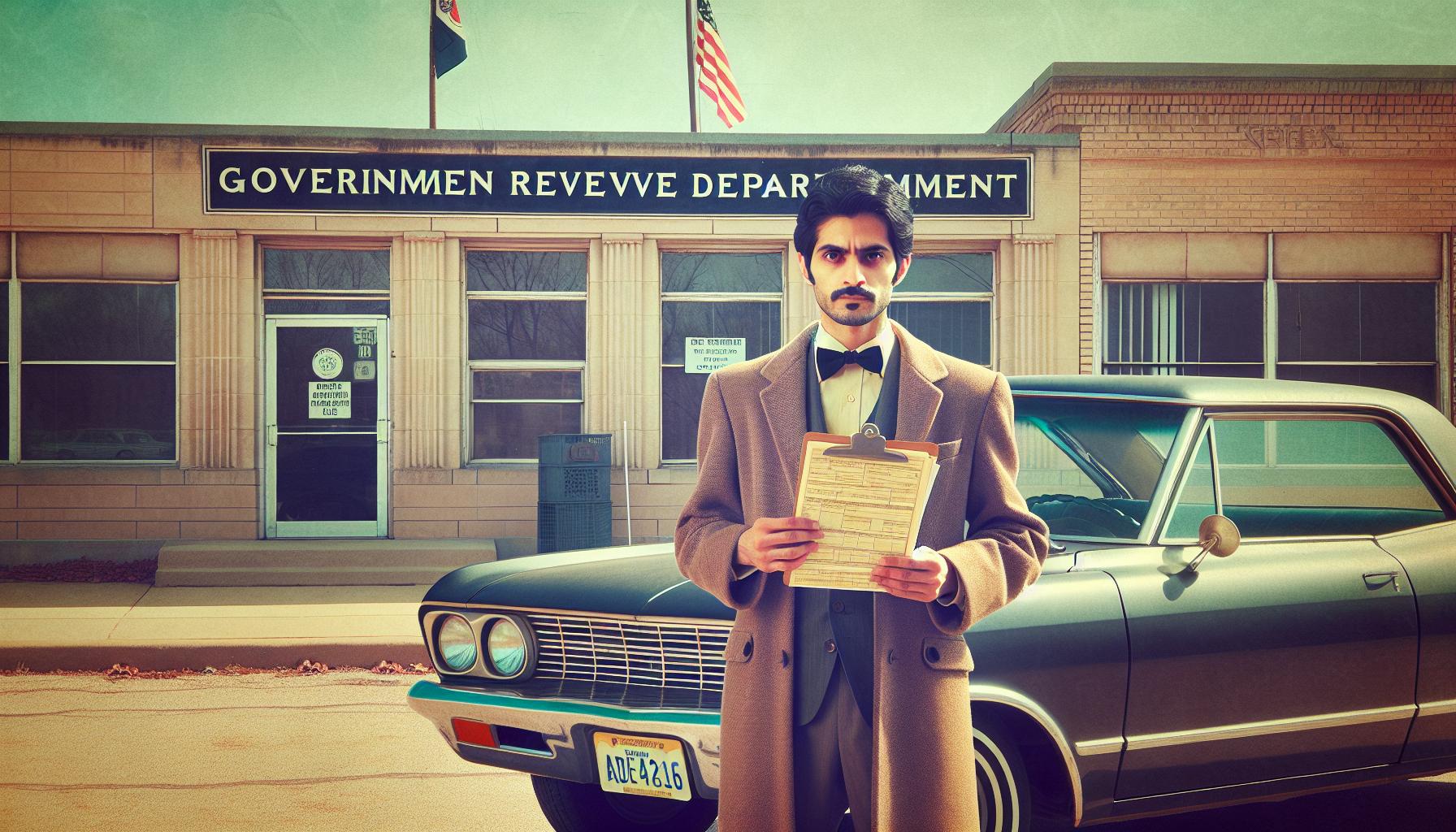

Secondly, Missouri employs strict regulations regarding vehicle ownership, hence the emphasis on proving legitimate ownership. Owners holding a Missouri bonded title can easily register their vehicle with the Department of Revenue in the state. Without the proper title, registry would be near impossible. Therefore, a bonded title doesn’t just validate ownership but also facilitates smoother transactions and processes surrounding vehicle ownership.

The Process of Getting a Bonded Title in Missouri

Partaking in the roadmap for acquiring a bonded title in Missouri, the path unfolds with assessing the necessity of a bonded title, followed by the strategic steps towards its attainment.

Evaluating If You Need a Bonded Title

Identifying the need for a bonded title relates to specific circumstances. Cases typically involve the unavailability or loss of a vehicle’s title upon purchase. Instances where sellers provide insufficient documentation, or if the car is from an out-of-state sale sans title, also pose potential scenarios. The need for a bonded title escalates notably when a vehicle’s origins remain questionable—a bonded title provides legitimate ownership proof, minimizing legal ramifications. An authoritative source, like the Department of Revenue, solidifies valid cases that necessitate bonded titles.

Steps to Obtain a Bonded Title

Experience dictates that Missouri’s process for obtaining a bonded title follows a series of prescribed steps. Consider commencing with a request for a VIN (Vehicle Identification Number) inspection. Law enforcement officers commonly perform this examination, crucial to verify a vehicle’s existence and match its associated data. Application for a title bond remains the second step. Missouri demands a surety bond that corresponds to the vehicle’s appraised value—a measure that underwrites legal ownership.

The successful procurement of a surety bond segues into the third step, compiling an application packet. This bundle embodies documentation like the completed Application for Missouri Title and License (Form DOR-108), the VIN inspection report, and surety bond.

Delivering the application packet to a local Missouri Department of Revenue office constitutes the final step. Here, payment for title fees and taxes occurs.

Remember that each case manifesting the need for a bonded title may determine procedural deviations. Hence, consulting local Department of Revenue offices or seeking legal advice often proves judicious.

Costs Associated With a Bonded Title in Missouri

Securing a bonded title in Missouri involves both direct and indirect expenses. These expenditures typically encompass application fees and the cost of a surety bond, also known as bonded title insurance.

Application Fees for Bonded Titles

Applicants encounter several fees within their pursuit of a bonded title in Missouri. The picture becomes clearer when noting the title application fee amounts to $11, as cited by authoritative sources. Apart from this, costing includes a processing fee of $6. Nonetheless, prospective applicants must keep a substantial allowance for potential cost additions. For instance, sales tax and property tax, creditable to vehicle value, might escalate overall expenses.

Bonded Title Insurance Costs

Another unavoidable aspect of procuring a bonded title in Missouri pertains to bonded title insurance, or a surety bond. The cost of this safeguard manifests in its requirement – a coverage amount equal to 1.5 times the vehicle’s assessed value. Hence, if a vehicle’s value estimates at $10,000, the consequent surety bond would demand $15,000 in coverage. Thus, bonded title insurance costs can significantly add to the total expenditure related to bonded titles in Missouri.

Potential Challenges With Missouri Bonded Titles

Securing a bonded title in Missouri might pose certain hurdles and challenges for citizens. This segment discusses various complexities associated with Missouri bonded titles, providing readers with a clearer understanding of potential difficulties and how to mitigate them.

Dealing With Lost or Unavailable Titles

Instances of losing or having unavailable auto titles can lead to confusion and stress. In such cases, the primary concern lies in establishing legal ownership of a vehicle. It’s crucial to ensure the non-interference of previous owners or any third parties claiming ownership rights.

A VIN inspection, necessary for obtaining a Missouri bonded title, inflicts another layer of complication. This process checks the authenticity and legality of the vehicle. If not performed correctly, this audit could increase the risk of potential legal difficulties. For example, if the vehicle in question was stolen or involved in fraudulent activity, the applicant may face legal liabilities.

Lastly, the timeline to receive a bonded title isn’t rigid and can take several weeks. This delay could pose challenges for owners needing a title quickly for car registration or to fulfill other legal obligations.

Addressing Legal Issues With Bonded Titles

In the realm of Missouri bonded titles, entanglement in legal issues is a common concern. When applying for a bonded title, providing incomplete or inaccurate documentation can lead to complications or delays. Consequently, if you’re acquiring a vehicle from another party, ensure the receipt of all necessary documents at the time of sale.

Additionally, the cost of bonded title insurance, a pivotal segment of the process, is contingent on the vehicle’s assessed value rather than its market or resale value. Thus, a higher assessed value results in a higher bond cost, frustrating individuals with vehicles assessed higher than their sales price.

Lastly, the approval for a bonded title doesn’t automatically eliminate the risk of claims by previous owners or lienholders. If such claims surface, the bonded title owner may face financial liabilities, escalating the matters into legal battles. Being aware of these potential legal difficulties and knowing how to address them is crucial for Missouri residents planning to obtain a bonded title.

Benefits of Having a Bonded Title in Missouri

This section delves into the advantages tied to bonded titles in Missouri. Acknowledging the complexities inherent in transferring vehicle ownership, these titles proffer a multitude of benefits such as resolving ownership disputes and facilitating vehicle sales.

Resolving Ownership Disputes

Possessing a bonded title in Missouri is instrumental in resolving ownership disputes. For instance, in cases where the vehicle’s previous owner or lienholder might make a financial claim over the vehicle, with a bonded title, the claimant might end up dealing with the surety bond company instead of the current owner. By doing so, bonded titles deflect the burden of potential claims from the bonded title owner, providing a safety net in the event of legal suits.

Facilitating Vehicle Sales

Bonded titles also aid in vehicle sales in Missouri. Specifically, they enhance the saleability of a vehicle with lost or missing titles. Such is the case because a bonded title serves as a clear indicator of verified ownership, pushing forth a smoother and more reliable transaction. Additionally, potential buyers gain a higher sense of security knowing they won’t grapple with unforeseen ownership disputes or financial liabilities. In this way, Bonded titles foster an enabling environment for seamless vehicle transfers, reinforcing the confidence of both sellers and buyers.

Discover the Power of BlueNotary:

Integrate your Business, Title Company, or Law Firm to Satisfy your Customers and Decrease Turnaround

Get a document Notarized/Sign-up

Join the Free Notary Training Facebook Group

Conclusion

Navigating the ins and outs of vehicle ownership in Missouri can be tricky, especially when dealing with lost or unavailable titles. That’s where bonded titles come into play. They’re a lifeline for those who’ve bought a vehicle without a proper title, offering a legal proof of ownership. From VIN inspections to filing for a surety bond, the process may seem daunting, but it’s a necessary path to establishing legal ownership. Despite potential challenges and costs, the benefits of a bonded title are undeniable. It’s a shield against claims from previous owners and a confidence booster for prospective buyers. So, if you’re stuck in a title conundrum, don’t fret. A bonded title could be your ticket to a smooth, secure vehicle ownership experience in Missouri. Remember, it’s always wise to seek legal advice or consult local authorities to ensure you’re on the right track.

What is a bonded title?

A bonded title, also known as a surety bond title, is a legally recognized proof of ownership for vehicles with lost or unavailable titles. It’s like an insurance policy, guaranteeing your legal ownership.

Why are bonded titles important in Missouri?

In Missouri, a bonded title provides security for vehicle owners and simplifies the registration process with the Department of Revenue. It especially helps when a vehicle’s original title is lost or wasn’t given upon purchase.

What is the process of obtaining a bonded title in Missouri?

First, you verify the necessity of a bonded title, usually due to a lost title or insufficient documentation. You’ll then request a VIN inspection and apply for a title bond equal to the vehicle’s value. Next, compile an application packet with all the required documentation. Finally, submit your application to your local Department of Revenue office along with the necessary fees and taxes.

What are the associated costs of securing a bonded title in Missouri?

The title application fee is $11, with a $6 processing fee. Sales tax and property tax will additionally apply. Also, you’ll need a surety bond coverage equal to 1.5 times the vehicle’s assessed value, which can significantly impact your total expenditure.

What are some challenges with Missouri bonded titles?

Challenges primarily arise from establishing legal ownership when titles are lost or unavailable. Incomplete documentation or claims by previous owners or lienholders can lead to legal and financial liabilities. Also, delays in receiving a bonded title can complicate registration processes.

What are the benefits of having a bonded title in Missouri?

A bonded title can aid in resolving ownership disputes and facilitates vehicle sales. It provides a safety net against claims from previous owners or lienholders and serves as clear proof of ownership, making transactions smoother and inspiring confidence in both parties.

Leave a Reply